Tell Your Elected Leaders that It's Time for the 1% to Pay their Fair Share Can you take one

Can you take one minute to send your representative an email telling them to close the budget gap by taxing the wealthy, not by cutting services to working people? Click here to send the email.

Albany’s response to New York’s $6.1 billion deficit: cut critical funding for the people who need it.

These cuts will hurt tens of thousands of our members and their jobs, and they threaten to raise all of our property taxes as well if the state shifts costs onto towns and counties.

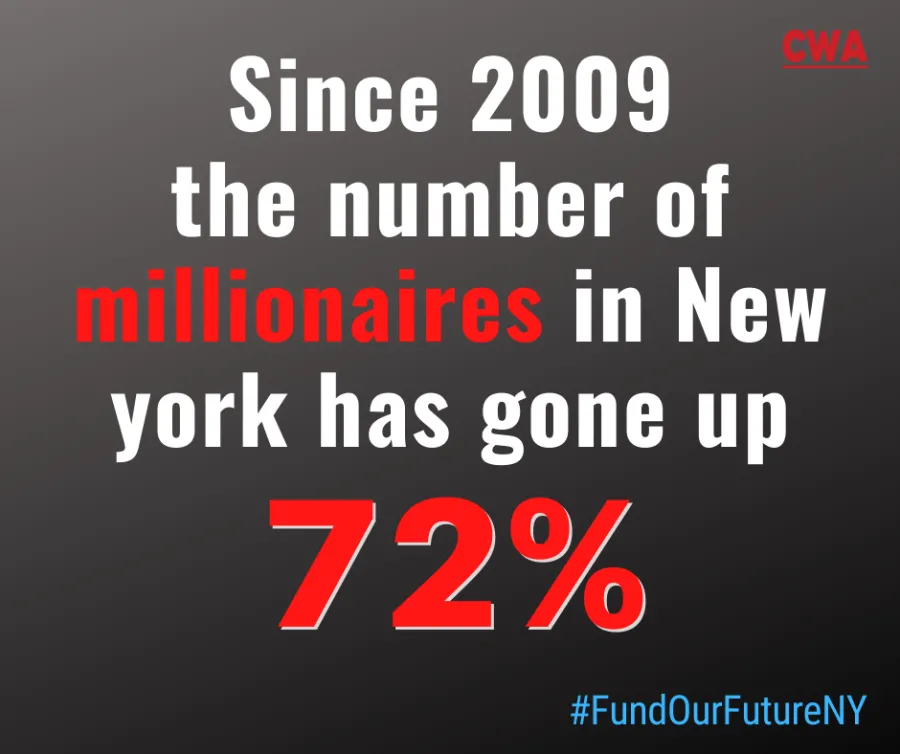

New York is already the most unequal state in the country. The richest 1% have an average income of $2.2 million—44 times higher than the average income of the other 99%. The ultra-rich can and should pay their fair share.

We believe the Legislature should consider at least four common sense revenue-raisers that will generate billions of dollars and close the budget gap without devastating cuts to public services:

Millionaires Tax: higher income tax brackets for income above $5 million per year

Wealth Tax: a 2% tax on “wealth” - stocks, bonds, mansions, etc. - of NYS billionaires

Pied-a-Terre Tax (S.44 / A.4540): a tax on luxury second homes in Manhattan worth $5 million dollars or more

Corporate Stock Buyback Tax (S.7629 / A.9748): An annual tax on corporate stock buybacks at the rate of 0.5%

We're asking all of our elected representatives to commit to fighting for these common sense tax reforms on the ultra-rich instead of slashing critical funding for New York's working families, because the 1% can afford to pay their fair share!

Click here to send the email. Thank you!

Why CWA Local 1101 Executive Board is Recommending a NO vote

Verizon Wireless (Network techs)/CWA Memorandum of Understanding